Terra Software Platform Yields Gaiascope’s 60%+ Gains in ERCOT

Terra, by Gaiascope, is a next-generation software solution that increases profits for renewable energy and storage asset owners, independent power producers, utilities, and developers through superior grid-wide modeling, forecasting, insights, and bid recommendations.

SUMMARY:

After four years of research, engineering, live testing, and improvement, Gaiascope is excited to unveil our software platform: Terra. Terra has achieved outstanding returns in ERCOT through its proprietary combination of:

-

- Artificial Intelligence (AI)

- Power Flow Modeling

- Client-Specified Risk and Strategy Limits

Terra is continuously overseen and managed by the Gaiascope team of experienced traders and developers, which tests and validates Terra’s results daily in real-time through Gaiascope’s managed trading fund.

To learn more about Terra, connect with the Gaiascope team here: contact Gaia.

In this post we discuss:

-

- What Is Terra

- Why Gaiascope Created Terra for wholesale markets

- The Terra And Gaiascope Advantage for solar, wind, and storage asset owners

- Terra’s Unique Approach to analyzing and navigating real-time and day-ahead electricity markets

- A behind-the-scenes look at Building And Maintaining The Terra Engine

WHAT IS TERRA?

Terra is a software platform designed to improve the profitability of renewable energy asset owners through its superior grid-wide modeling, forecasting, insights, and bid recommendations. Terra combines the advanced capabilities of AI with traditional power flow modeling and trading optimization into one comprehensive software solution for Gaiascope clients.

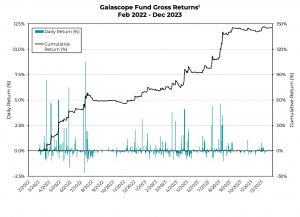

Terra’s accuracy and performance are tested and proven every hour of every day through Gaiascope’s managed trading fund, which has generated >60% annual gross returns¹ over the last two years as a direct result of Terra’s capabilities (see Figure 5).

Terra is currently available for renewable energy asset owners in ERCOT with expansion into MISO and CAISO in 2024.

WHY GAIASCOPE CREATED TERRA:

The challenges tied to our evolving grid are becoming increasingly complex to navigate. Intermittency, reliability, and unpredictability issues are creating increased price volatility and congestion across electricity markets.

Figure 1: ERCOT Price Volatility is Increasing

Note: 2021 values out of graph due to Winter Storm Uri. The trend line conservatively excludes 2021 as an outlier. Data include ERCOT hubs: NORTH, SOUTH, HOUSTON, WEST, PAN.

Figure 2: ERCOT Congestion is Increasing

Note: Trend line includes all values, as 2022 congestion spikes exceeded 2021 (which includes congestion spikes from Winter Storm Uri). Data include ERCOT hubs: NORTH, SOUTH, HOUSTON, WEST, PAN.

These trends are often far more dramatic at the nodal level. What looks like minor price spikes and congestion at the hub level can correspond to nodal price movements in the thousands of $ per MWh. This nodal pricing can make or break an asset’s year (discussed further in our previous blog post).

At Gaiascope, we view these increasingly common spikes as opportunities: if harnessed correctly, they can enhance the profitability and rapid expansion of decarbonized energy generation. This is why Gaiascope created Terra.

THE TERRA AND GAIASCOPE ADVANTAGE:

Put simply, Terra:

-

- Accumulates, synthesizes, and analyzes data across a multitude of sources,

- Leverages:

-

- AI capabilities

- Power flow (fundamental) modeling

-

- Generates probabilistic forecasts for every hub, load zone, and nodal price point in ERCOT,

- Applies client-specified strategy and risk policies,

- Returns client-specific bid recommendations and digestible market insights.

The Result?

-

- Superior forecasts rooted to the grid’s physical design, limitations, and dynamic fluctuations,

- Enhanced ability to perform on volatile days when forecasting accuracy matters most,

- Client-centric bid optimization,

- More profit in the pockets of asset owners who are decarbonizing our grid.

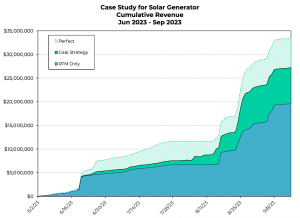

Figure 3: Terra Adds $7M of Revenue in Three Months for Solar Generator

Note: Above, “RTM Only” represents the baseline scenario, where the asset is simply a price taker in the RTM. “Perfect” represents the ability to capitalize on the best pricing in RTM or DAM for every MW of real-time generation. “Gaia Strategy” utilizes Terra’s forecasting ability and specific risk/return optimization for trading the asset.

For example, on August 25th, ERCOT’s day-ahead market predicted prices between $2,500/MWh and $4,500/MWh for hours ending 16-19. Terra’s probabilistic forecast predicted real-time prices would be much lower, and advised the solar generator to sell into the day-ahead market at a lower price than the day-ahead clearing price. As a result our client was able to clear the day-ahead market. When real-time prices came in much lower than the day-ahead market predicted ($600/MWh to $2,500/MWh for those hours), our client was able to capture significant profit from that day-ahead premium (see Figure 4).

Figure 4: Terra can produce superior forecasting and bid recommendations relative to ERCOT, even during extreme market pricing scenarios

In addition to load and generation forecasting, Terra has robust congestion forecasting baked into its nodal price forecasts. This fuels more precise price forecasting and provides insight into the key drivers behind pricing.

Terra’s ability to drive profits is further evidenced by Gaiascope’s managed trading fund. Our fund’s successful trading performance is a direct function of Terra’s ability to forecast grid dynamics.

Figure 5: Terra drives Gaiascope’s managed fund, which has generated over $8 million in gross profit and >60% annualized gross return¹

Note: AUM over this time period ranged between $2.5m to $17m and averaged $11m.

Our clients can trust that as an active market participant, Gaiascope truly understands the risks of these markets and the critical importance of both forecasting accuracy and trading strategy.

TERRA’S UNIQUE APPROACH:

Terra lays the stage for how our grid will operate in the future. Hub and nodal prices are impacted by more factors than the human brain (or a team of brains) can process. Especially given the growing challenges stemming from technology shifts across both supply and demand, the grandfathered industry approach to modeling and optimizing the grid is becoming increasingly incapable of capturing the grid’s complexities and maintaining grid balance. Only AI can comprehensively analyze and provide a complete understanding of the grid with the speed required for asset optimization.

However, an AI-only approach has limitations where fundamental analysis can triumph. Terra recognizes both realities and combines the power of AI with detailed fundamental power flow modeling.

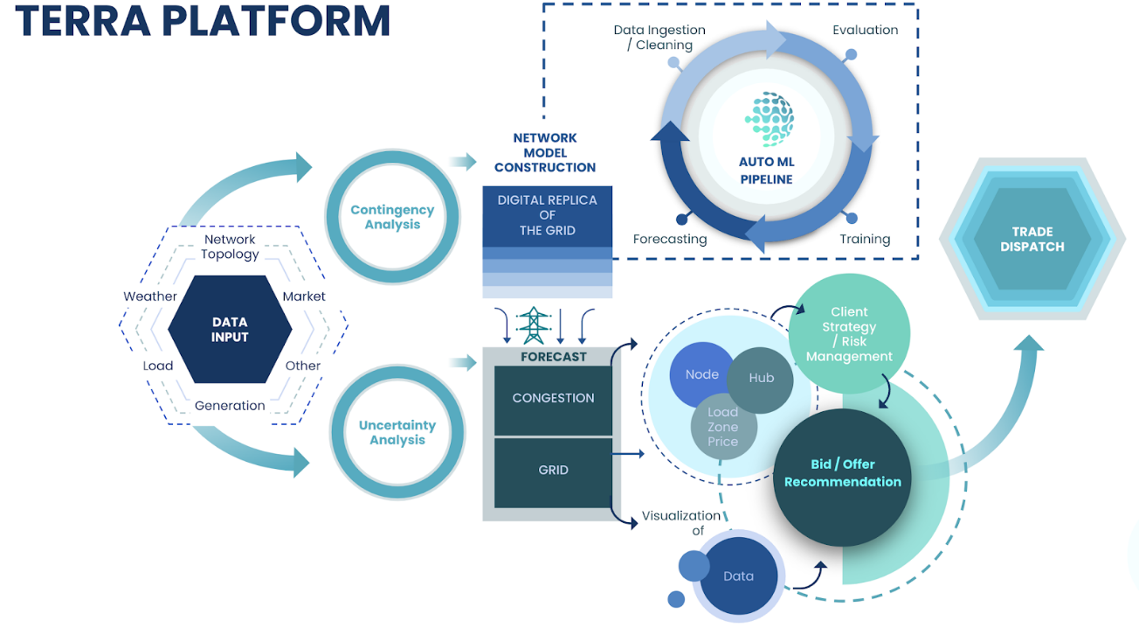

Figure 6: Terra combines the power of AI with rigorous fundamental power flow modeling to produce a comprehensive, physically-rooted understanding of the grid

Each of Terra’s processes shown above (‘Data Input,’ ‘Contingency Analysis,’ ‘Auto ML Pipeline,’ etc.) contains a number of components that together forge Terra’s understanding of grid activity. You can think of Terra as a rocketship: each process is akin to a critical system of the rocket, such as propulsion and life-support. And within each system are crucial components like guidance computers, fuel tanks, and life-sustaining apparatus. The engineering and performance of each component MUST work in concert to enable system performance. In other words – the meticulous engineering required, along with thoughtful integration of systems, is what allows the Terra rocket to withstand significant launch, navigation, and ongoing challenges, and to accomplish its mission… 24/7/365.

To exemplify the engineering complexities within each of Terra’s systems, let’s dive into ‘Contingency Analysis’: within this process, Terra calculates shift factors for each of the 13,000 buses in ERCOT. A shift factor is a measure of how much each bus contributes to flow on transmission lines, and subsequently how sensitive each bus price will be (e.g., if line L is overloaded, this is how bus B will respond in price). Terra completes these 13,000 shift factor calculations, not just once, but for many potential topology states. More specifically…

-

- For the thousands of possible contingencies in ERCOT (i.e., the lines, generators, transformers, or groups of lines, generators, and transformers that may have an outage or operational limitation), Terra determines which contingencies are most likely. Let’s say there are 50 in a given hour.

-

- For each of these 50 events, Terra determines the topology implications and calculates all 13,000 bus-level shift factors in ERCOT accordingly.

-

- Terra runs 100 simulations of the grid, for each of these 50 contingencies.

-

- As part of each simulation, Terra combines the calculated shift factors with anticipated shadow prices (calculated separately) to get price distributions for each price point on the grid (where each price point distribution has 100 possible prices stemming from the 100 forecasts).

-

- In this example, Terra is running 5,000 different scenarios and generating 65 million price forecasts for a single hour. This process is repeated for every hour of every day, and remember this is just a portion of the Terra process.

-

- As part of each simulation, Terra combines the calculated shift factors with anticipated shadow prices (calculated separately) to get price distributions for each price point on the grid (where each price point distribution has 100 possible prices stemming from the 100 forecasts).

-

- Terra runs 100 simulations of the grid, for each of these 50 contingencies.

-

- For each of these 50 events, Terra determines the topology implications and calculates all 13,000 bus-level shift factors in ERCOT accordingly.

-

- For the thousands of possible contingencies in ERCOT (i.e., the lines, generators, transformers, or groups of lines, generators, and transformers that may have an outage or operational limitation), Terra determines which contingencies are most likely. Let’s say there are 50 in a given hour.

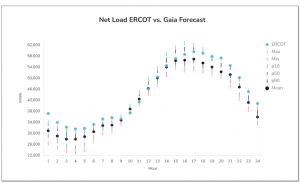

This exceptional attention to modeling for each of Terra’s systems produces superior results and allows Terra to identify key drivers of real-time price anomalies, rather than being a “black box.” Gaiascope clients can then access Terra’s forecast and market insights through our dashboard:

Figure 7A: Terra identifies key drivers of real-time price anomalies which clients can access through the Gaiascope dashboard

Above, Gaiascope forecasts lower net load than ERCOT outside of the mid-day hours. Users can choose any other hour to review and view the 24-hour charts.

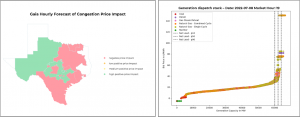

Figure 7B: Terra provides congestion and generation stack forecasts which clients can access through the Gaiascope dashboard

Clients can also view Terra’s proprietary stack model forecast and congestion insights through the Gaiascope dashboard.

Terra’s bid recommendations are sent directly to clients in a CSV and can be integrated with a 3rd party (e.g., Snowflake).

Gaiascope is aware that not every client’s needs are the same. Whether you have defined risk policies and specific trading mandates in place, or you would like assistance generating more successful risk and trading strategies, our team takes time to understand each client. We will help you analyze your exposure, adhere to your internal requirements, and work with you to develop a complete Terra solution that integrates successful, client-centric risk and trading strategies.

BUILDING AND MAINTAINING THE TERRA ENGINE:

Creating Terra did not happen overnight. It is the culmination of over four years engineering, testing, iteration, and continuous updates. Behind the scenes, Terra requires:

-

- Over 315,000 lines of Python code published over four years by the Gaiascope team with over 26,000 individual commits.

- Ongoing oversight and continuous updating by Gaiascope’s dedicated team:

-

- Our full-time technical team monitors all live processes in real-time, 365 days a year.

- We diligently streamline the existing codebase to ensure the most efficient runtime possible and work to address (within minutes or even seconds) any issues that threaten downtime.

-

- Robust Back-end Engineering:

-

- Our dedication to back-end design and efficiency is what makes Terra’s daily comprehensive analysis of these markets possible. Our back-end infrastructure allows Terra to:

-

- gather, parse, verify, and process Terra’s immense amount of input data,

- run several complex analyses in parallel,

- generates probabilistic forecasts for every tradeable price point,

- optimize client bids, subject to unique risk and strategy limits,

- …

-

- Our dedication to back-end design and efficiency is what makes Terra’s daily comprehensive analysis of these markets possible. Our back-end infrastructure allows Terra to:

-

…all with an efficient run-time.

ABOUT GAIASCOPE:

Gaiascope is dedicated to maintaining planetary balance, and we know the best way to drive investment in sustainable energy assets is to make those assets as profitable as possible. For every $1 million invested in a sustainable energy asset instead of fossil fuels, that’s 2 million metric tonnes of annual CO2 avoided. We do our part by providing clients the best possible tool to optimize returns of their wind, solar and storage assets.

To learn more about Gaiascope or to contact us with any inquiries or requests: contact Gaia.

¹Past performance is not indicative of future results. This is not an advertisement and is neither an offer to sell nor a solicitation of an offer to purchase any of the securities or products described herein.