Trading Retro #3

Gaiascope experienced its most profitable day yet on July 13th, driven by our software correctly forecasting regional dynamics on the grid. This time, Gaiascope generated >$400,000 in 5 hours (>7x ROI on cost of trades cleared).

On July 13th, Load Zone prices in Central Texas recorded highs of $5,000/MWh, averaging $1,212/MWh over the course of the day.

FIG. 1: REAL-TIME PRICE OF LOAD ZONES, $/MWH, 7/13/22

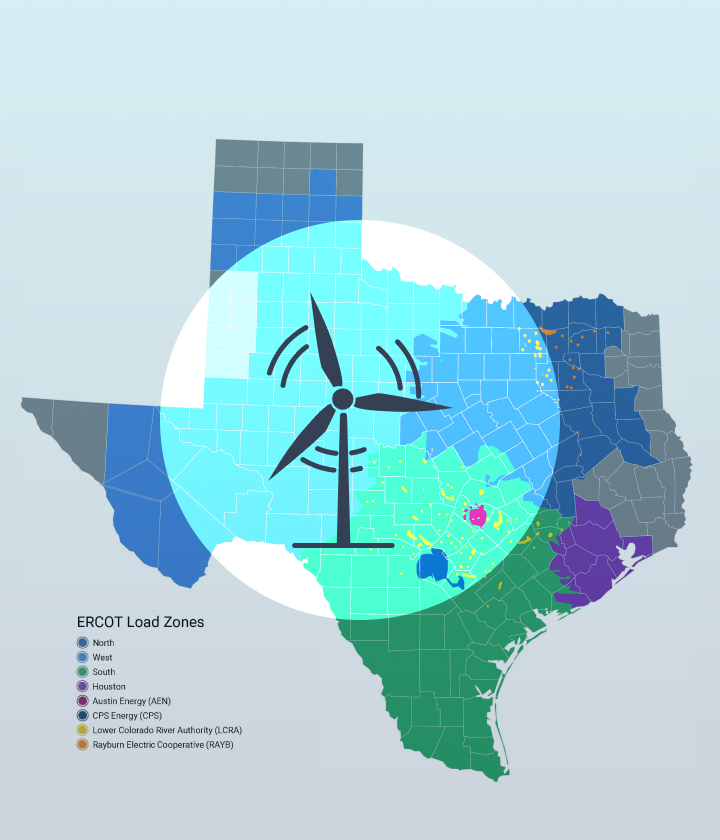

While prices in South Texas reached highs near $5,000/MWh, the regional price quickly declined relative to others as high winds in the afternoon drove high production from wind power, depressing prices relative to the rest of Texas and ultimately resulting in a >$2,000/MWh differential at peak.

FIG. 2: SOUTH TEXAS WIND FORECAST VS. ACTUAL, 7/13/22

Gaiascope forecasted this dynamic the day prior—importantly, anticipating higher wind production in South Texas than ERCOT (see Fig. 2)—and submitted the following related bids:

FIG. 3: BIDS SUBMITTED INTO DAY-AHEAD MARKET

Gaiascope’s forecast assumed:

-

2 specific transmission elements would be congested: PAWNEE_SPRUCE_1, PAWNEE_TANGO1_1

-

Output from wind in south Texas would be high, including:

– Reloj del Sol wind (209 MW)

– Javelina wind (450 MW)

– Torrecillas wind (301 MW)

– Karankawa wind (307 MW)

– Algodon wind (online May 2022, 200 MW)

– Not yet forecasted: Helena/Foxtrot wind (online July 2022, 268 MW)

FIG. 4: GAIA FORECAST FOR JAVELINA I WIND 20 UNIT, 7/13/22

All in all, correctly anticipating this price differential resulted in >$400,000 of revenue (>7x ROI), highlighting the value of accurate, actionable price forecasts.

___

To learn more about Gaiascope’s capabilities, please inquire on our Contact Us page or email us at founders@gaia-scope.com.

THE FOREGOING DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, SECURITIES IN ANY JURISDICTION IN WHICH IT IS UNLAWFUL TO MAKE SUCH AN OFFER OR SOLICITATION.