Trading Retro #2

High temps, higher prices…

On April 5th, 2022, prices across major cities in Texas blew up as temperatures rose into the high 90s, setting a new record for the day. This time, Gaiascope generated >$100,000 in 3 hours. (Fun fact #1: had we been a bit more aggressive on our bid pricing, we would have made over $1.7 million on the day 😲!… but that’s a blog post for another time. Fun fact #2: our weather anomaly algorithms detected a P99-level temperature spike, aka a temperature higher than 99% of historical days, up to 9 days prior.)

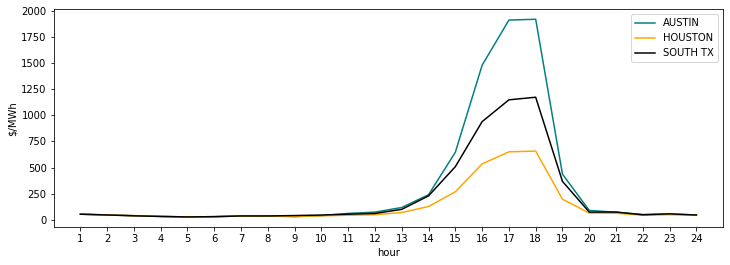

On April 5th, Load Zone prices in central, south and coastal Texas hit highs of $657 – $1,922/MWh, averaging $236/MWh over the course of the day:

FIG. 1: REAL-TIME PRICE OF LOAD ZONES, $/MWH, 4/5/22

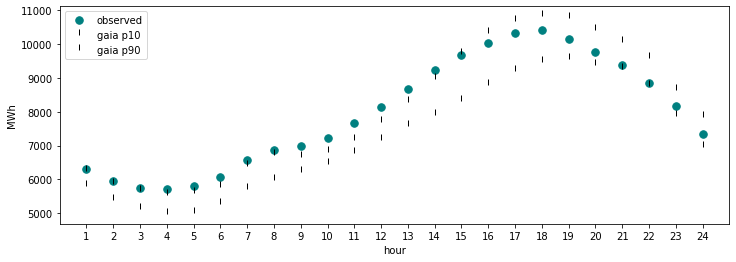

FIG. 2: GAIASCOPE ANOMALY DETECTION

While spiking demand drove grid-wide prices higher, the difference in regions was caused by congestion: high regional demand and low output from local generation (hydro, nat gas, solar, storage) resulted in demand needing to be met by more expensive, less accessible generation, which overloaded transmission lines in each region.

Gaiascope forecasted certain of these dynamics the day prior (we weren’t perfect, but we were directionally correct) and submitted the following related bids:

FIG. 3: BIDS SUBMITTED INTO DAY-AHEAD MARKET

Gaiascope’s forecast predicted:

-

5 specific transmission elements would be congested: 211T147_1, 1661__A, 255T279_1, 583T583_1 and 460T460_1.

-

Output from plants most capable of alleviating this congestion would be low:

-

Decker Creek natural gas plant (we think 420 MW was retired a week earlier on 3/31/22…remaining capacity 192 MW)

-

North Fork battery storage (100.5 MW)

-

Austin, Buchanan, and Marshall Ford hydro plants (174 MW)

-

Sandhill Energy Center natural gas plant (563 MW)

-

Helios solar plant (100 MW)

-

Ranchtown battery storage (9.9 MW)

-

FIG. 4: GAIASCOPE FORECAST FOR SANDHILL ENERGY CENTER NATURAL GAS PLANT, 4/5/22

FIG. 5: GAIASCOPE FORECAST FOR MARSHALL FORD HYDRO PLANT, 4/5/22

.

FIG. 6: GAIASCOPE SOUTHCENTRAL TEXAS DEMAND FORECAST VS. ACTUAL, 4/5/22

All in all, correctly anticipating this price spike resulted in $113,189 of revenue, highlighting the value of accurate, actionable price forecasts.

___

To learn more about Gaiascope’s capabilities, please inquire on our Contact Us page or email us at founders@gaia-scope.com.

THE FOREGOING DOES NOT CONSTITUTE AN OFFER TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, SECURITIES IN ANY JURISDICTION IN WHICH IT IS UNLAWFUL TO MAKE SUCH AN OFFER OR SOLICITATION.